Becoming a Better Investor – Part I: Acquiring Knowledge

Once again, someone has gone to the trouble of measuring the state of financial literacy among American investors, and once again, has found it to be dismal. This time it was the FINRA Investor Education Foundation and the Global Financial Literacy Excellence Center at the George Washington University School of Business. The study titled, New Evidence on the Financial Knowledge and Characteristics of Investors, included about 15,000 Americans, aged 25 to 65, who were not retired or in school. They were categorized as either workplace-only investors, active investors, or non-investors. The authors summarize the importance of this study as follows:

“Research shows that financial literacy matters; investors with low levels of financial knowledge are more likely to exhibit poor investing behavior: diversifying naively, failing to identify dominated funds, and paying higher fees.”

Naïve diversification refers to putting equal amounts of money into every available fund in a 401(k) plan (a bad idea because it will likely result in an inappropriate amount of risk undertaken), and a dominated fund is one that is guaranteed to perform worse than a readily available alternative. For example, the Nationwide S&P 500 Index A fund (GRMAX) with its 5.75% front-end load and 0.59% expense ratio is dominated by the no-load Vanguard 500 Index Fund. As terrible as the expense structure is of the Nationwide fund, it has still garnered over a billion dollars of assets, proof that many investors do not understand the concept of a dominated fund.

Participants were asked a series of basic questions covering the topics of risk diversification, asset pricing of bonds, compound interest, inflation, and mortgage payments. Only one-third of investors were able to correctly answer the asset pricing question by demonstrating an understanding of the inverse relationship between interest rates bond prices. Only 38% were able to correctly choose a broad estimate of how many years it would take a loan balance to double with a 20% compound interest rate (between 2 and 5 years). Lastly, only 56% knew that buying a single stock is inherently riskier than a stock mutual fund.

At Clarity Capital Advisors, we strongly believe that the basics of finance should be taught to everybody, starting in high school. While it’s sometimes included in home economics, it’s usually at a rudimentary level (e.g., creating a budget) and doesn’t help students become good investors or wise consumers of financial products such as mortgages, credit cards, life insurance, etc.

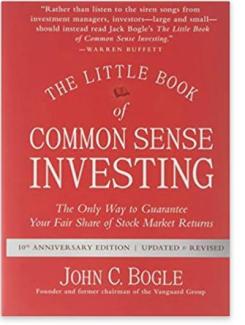

If there is an area of finance where you believe you need to learn more, please feel free to reach out to us. We are here for you. In the meantime, if you haven’t read the book shown in the photo above, please do so.