Low-Cost, Tax-Efficient Investments From Dimensional, Vanguard, and Avantis Investors

Dimensional

Dimensional is a leading global investment firm that has been translating academic research into practical investment solutions since 1981. Guided by a strong belief in markets, Dimensional* builds and manages strategies to help clients pursue higher expected returns. The firm works closely with leading financial academics to identify new ideas that may benefit investors and applies a dynamic investment process that integrates advanced research with careful portfolio design and implementation, while balancing the investment tradeoffs that can impact returns.

Dimensional has a long history of putting financial science to work for clients. In 1981, the firm introduced its first strategy, a US small cap strategy, to help institutional investors diversify beyond large cap stocks. The launch coincided with research documenting the stronger performance of US small cap stocks. Over the years, Dimensional has created a full suite of global equity and fixed income strategies in response to new research and evolving client needs.

Dimensional is headquartered in Austin, Texas, and maintains trading offices in North America, Europe, and the Asia-Pacific region. As of September 30, 2022, Dimensional* manages $540 billion for investors worldwide.

*“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., and Dimensional Japan Ltd.

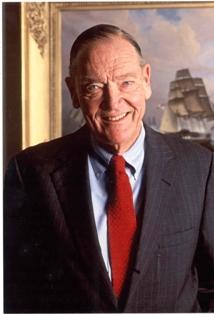

Vanguard's founder and former chairman John C. Bogle is credited with the creation of the first index fund available to individual investors, and the popularization of index funds is driving costs down across the mutual fund industry. This phenomenon has been described as "The Vanguard Effect."

With its unique mutual structure of ownership by its shareholders, Vanguard does not have to answer to either the stock market or to a small group of private owners. This ownership structure allows Vanguard to run their funds "at cost" rather than having to build in a profit margin for the owners.

Aside from being the industry cost leader, Vanguard is an excellent provider of education to investors and is widely considered to be a thought leader in the industry. Vanguard has over forty years of experience managing index funds and is now the largest provider of mutual funds and the second largest provider of exchange-traded funds (ETFs) in the world. It now offers a suite of U.S. equity funds based on indexes from the Center for Research in Security Prices (CRSP) and its foreign equity index funds are based on FTSE indexes that include exposure to both small cap and value companies. Vanguard’s bond funds have some of the lowest costs available, which is especially important in today’s low yield environment.

An Evolutionary Step Forward for Passive and Active

Avantis Investors™ was established to help investors achieve their investment goals through a persistent focus on providing well-diversified investment solutions that fit seamlessly into asset allocations and combine the potential for outperformance with the reliability of indexing.

Decades of Real-World Experience. Our leadership has decades of experience delivering repeatable and effective investment solutions across geographies and through different market cycles. The team is well recognized by investors worldwide.

Financial Science Lays the Foundation. Our investment approach is based on an academically-supported, market-tested framework that aims to identify securities with higher expected returns based on their current market prices and other company financial information.

Process Designed for Consistency. As part of our portfolio management and trading processes, we analyze whether the benefits of a trade overcome its associated costs and risks. We seek to methodically harness return premiums while controlling implementation costs and mitigating portfolio risks to generate enhanced returns over time.

Enables Advisors to Build Customized Asset Allocations. All Avantis Investors strategies will use the same academically sound risk/return framework uniquely designed for Avantis Investors. We use our understanding of investors’ needs to deliver transparent investment strategies that work well inside a broader asset allocation.

Cost Conscious. Scalable, efficient portfolio construction and engineering allows for broadly diversified solutions with low rebalancing costs, capital gains and fees. We expect to pass these savings on to our investors through lower management fees.