Retirement Planning

Your retirement is the most important financial goal you will fund during your career.

Our team of experienced and credentialed (CFA® and CFP®) financial professionals will work with you to establish sensible savings goals, retirement income strategies, and tax-efficient investment options to keep you on track.

Are you saving enough to retire on time?

These are some of the questions we will help you answer during our retirement planning session:

- I want to retire on time. How much should I save every year?

- What is the right asset allocation for my retirement goals?

- What types of retirement accounts would make the most sense for me from a tax perspective?

- What is a Roth IRA account? Am I able to contribute to one?

- What percentage of my income should I be contributing to my employer's retirement plan?

- Should I convert my traditional IRA to a Roth IRA?

- Should I put more money towards my mortgage?

- How can I save for retirement and my child's college education?

Are you approaching retirement or already retired?

If you are preparing for retirement or are already retired, you have probably asked yourself the following questions:

- How can I consolidate my accounts to simplify my finances for myself and my beneficiaries?

- Are my investments too risky for this point in my life? Should I be taking more risk?

- How much can I safely withdraw from my investment accounts each year?

- Should I take my Social Security benefits now or wait?

- How can a Roth Conversion help me reduce my Required Minimum Distributions (RMDs)?

- What are my options for meeting my Required Minimum Distributions?

- How do I move my money from my employer's retirement plan without incurring taxes?

- How do I setup an automatic deposit into my checking account from my investment accounts?

Designing a cash flow plan for retirement.

With the prospect of paying for retirement needs for as many as 40 years, retirees need to be concerned with maintaining their standard of living. First, we will ask you about your current monthly expenses, outstanding debt, and expected future expenses such as travel, relocation, home repair, new purchases, etc. Then we evaluate all of your sources of income such as employer-sponsored retirement plans, including 401(k) and 403(b) plans, Social Security, pensions, annuities, rental property, and investment assets. Your plan will incorporate your tax situation based on the assistance of your tax professional. Ultimately, we define success as producing a long-term plan that will last a lifetime.

Consider Delaying Social Security

Some Important Social Security Numbers

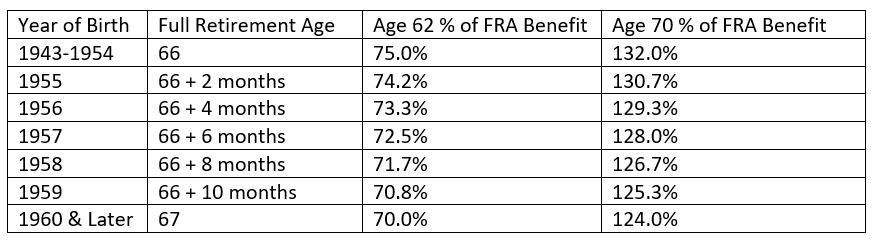

The table below shows the Social Security Full Retirement Age by year of birth along with the impact of taking benefits at ages 62 and 70. For someone born in 1955, the maximum age 70 benefit is $61,296 in 2025.

Review Your Retirement Plan Beneficiaries Periodically

Planning for the transfer of assets at death is a critical element of retirement planning especially if there are survivors who are dependent upon the assets for their financial security. We recommend that you review the beneficiaries listed on your employer retirement plan, IRA and Roth IRA accounts, and transfer-on-death accounts (for taxable accounts) at least annually. These beneficiary designations may override what is stated in your will.

Health Care Needs and Health Savings Accounts (HSAs)

Longer life spans can also translate into more health issues that arise in the process of aging. The federal government provides a safety net in the form of Medicare, however, it may not provide the coverage needed especially in chronic illness cases. Planning for long-term care, in the event of a serious disability or chronic illness, is becoming a key element of retirement plans today.

For 2025, those who have a high-deductible health plan ($1,650 individual or $3,300 family) are eligible to contribute to a Health Savings Account (HSA) in the amounts of $4,300 for individuals and $8,550 for families. Those age 55 or older may contribute an additional $1,000. These contributions are tax-deductible, grow tax-deferred, and are not taxed upon withdrawal for legitimate health care expenses.

Important Retirement Contribution Limits for 2025

401(k)/403(b) Employer Retirement Plans

The 2025 maximum 401(k)/403(b) employee contribution = $23,500 with a $7,500 age 50+ catch-up.

Defined Benefit and Cash Balance Plans

The limitation on the annual benefit of a defined benefit or cash balance plan is $280,000 in 2025.

IRAs and Roth IRAs

2025 Contribution limit = $7,000 with a $1,000 age 50+ catch-up.

Eligibility of Roth IRA contributions:

For single taxpayers, the phaseout range is now $150,000 to $165,000. For married couples filing jointly, the income phase-out range is $236,000 to $246,000.

SEP IRAs and Solo 401(k)s

For the self-employed and small business owners, the amount they can save in a SEP IRA or a Solo 401(k) is $70,000 in 2025 (with a $7,500 age 50+ catch-up for the solo 401(k)). The compensation limit used in the savings calculation is $350,000.