We are ERISA Plan Fiduciaries Who Serve Employers and Plan Participants Nationwide

We serve in a fiduciary capacity as an ERISA 3(21) Advisor or 3(38) Investment Manager. Let us help you decide which option is best for your plan.

Employers are no longer limited to the high-cost plan advisors and providers based in their state. We utilize online meetings via Zoom or face-to-face meetings depending on your location to meet with you and your employees one-on-one, in addition to our quarterly plan reviews, and ongoing phone and email support.

Clarity Capital Advisors is an independent, fee-only, fiduciary registered investment advisor firm legally bound by the fiduciary standard of care. We are held to the highest standard of responsibility to our plan sponsors and their employees.

Employers and plan participants save with our flat-fee plan pricing for 401(k) and cash balance plans.

This means more money is going toward funding employees' retirement accounts, instead of being paid out to high-cost plan providers and advisors.

When it comes to 401(k) profit-sharing plans and cash balance defined benefit plans, the less you pay for plan administration the more your keep in your retirement account. Plan sponsors benefit from our experience working with flat-fee plan providers, while providing their employees with quality financial guidance from our team of fiduciary plan advisors who are Certified Financial Planner (CFP) professionals and specialize in retirement planning and asset management. Our investment lineup includes an array of low-cost mutual funds, index funds, and target retirement funds from Vanguard, Fidelity, and Dimensional Fund Advisors. We do not engage in revenue-sharing or recommend mutual funds with hidden revenue-sharing 12b-1 fees.

Don't pay asset-based fees for your plan. Our flat-fee provides total fee transparency.

Low-cost plans. No advisor or provider asset-based fees. No hidden revenue-sharing 12b-1 fees. No high-cost mutual funds.

The Ideal Flat Fee 401(k) Profit-sharing Plan and/or Cash Balance Defined Benefit Plan

There is no need to waste your time searching for a new low-cost plan provider when we have our provider partnerships in place. Simply request a quote for your plan by calling 800-345-4635 ext. 0 or email us at retirement@clarityca.com. We will contact you for an introduction and ask a few questions regarding your existing plan.

Based on our conversation, we will search our low-cost, industry leading retirement plan providers and provide you with a fee transparent, competitively priced plan quote, including our fiduciary plan advisor fees. Normal turnaround time for a quote is 24 hours.

We reduce overall plan costs and increase investment returns.

As plan fiduciaries, we know what makes a good plan great, and it has a lot to do with keeping overall plan costs to a minimum. Unfortunately, the majority of plans out there are still paying excessive plan fees. High plan fees combined with high-cost investment options (some with hidden 12b-1 fees for revenue-sharing) can force employees to work longer because the fees take a significant portion of their investment returns over time.

Plan Administrators are busy professionals with the retirement plan being one of their many duties. Therefore, a plan may go many years without a fresh set of eyes looking for opportunities to reduce costs. We are that fresh set of eyes, and we can provide you with a better, low-cost plan for you and your employees.

Don't delay! Reap the benefits of moving your retirement plan now vs. at year end:

Six very compelling reasons not to wait until October 31st to begin the process of moving your plan for a January 1st start date.

- You and your employees will immediately save money on plan fees and expenses, and reap the benefits of our flat-fee platform for several months in the current year. In some cases, this could be tens of thousands of dollars! If you aren't sure what you are paying, ask us for a complimentary plan fee analysis.

- We will guide you through a smooth transition as all of the attention will be on your plan. Many employers procrastinate and wait until the 10/31 deadline, the busiest and worst time of the year.

- You avoid a plan transition and employee enrollment meetings during the busy holiday season.

- Some plan providers shut down the number of plans/assets that can be liquidated on a certain date (common for January 1 conversions due to the busy time at year end).

- You will be relieved of your frustrations or concerns with your current plan advisor and/or plan provider.

- Your current provider won't be responsible for year-end activity. In many cases. this is very good news.

Our Plan Partners are Low-Cost 401(k) and Cash Balance Plan Leaders

When it comes to selecting a retirement plan provider, costs, services provided, reputation and expertise are all very important. We believe our providers offer competitively priced plans with exceptional service and many years of experience in this market.

These are some of the plan providers we work with and each is unique in their offering. We bring our knowledge and expertise of each provider's platform to quickly eliminate those who do not meet the required criteria for your plan. Please take a moment to request a free quote for your retirement plan by calling 800-345-4635.

Features of the Clarity 401(k) Profit-Sharing Plan

- An array of ultra low-cost mutual funds, target retirement funds, and diversified model portfolios from Vanguard, Fidelity, and other low-cost mutual funds.

- Institutional and Admiral share classes for the best pricing. No hidden fees. No 12b-1 revenue sharing mutual funds.

- Flat-fee pricing makes it easy to provide full disclosure of all fees and charges associated with your plan.

- ERISA Fiduciary 3(38) Investment Manager or 3(21) Investment Advisor

- Customized Investment Policy Statement

- Plan Provider and ERISA Bond Monitoring

- Roth and Traditional 401(k) Options

- Automatic Enrollment/Automatic Escalation

- 404(c) Compliance

- Quarterly plan review call, as needed

- Quarterly benchmarking report and plan analysis

- Robust online interface for plan sponsors and a dedicated employee website with retirement planning tools

- Employee Risk Assessment

- Financial Wellness - We are Certified Financial Planner professionals, who meet with employees one-on-one online or in person to answer questions and discuss retirement planning, saving for a child's college education, retirement income planning, and their investing needs.

- Do you have an existing relationship with a third party administrator? Our plan providers are able to partner with many third party administrators.

Smart Investment Options for your Employees - No hidden fees, commissions, or revenue-sharing mutual funds.

Low-Cost Target Retirement Funds from Vanguard - Built on the principles of high diversification and low costs, these funds automatically adjust their risk level based on the number of years remaining to the targeted retirement date.

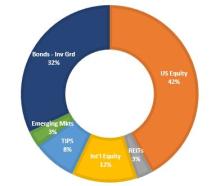

Low-Cost, Highly Diversified Model Portfolios - Our model portfolios range from conservative to aggressive allocations and are designed to capture the returns of broad market indexes offered across the global financial markets utilizing Vanguard, Fidelity, and Dimensional Fund Advisors mutual funds. No 12b-1 fees or revenue-sharing mutual funds.

Build Your Own Portfolio - Employees may choose from a wide selection of low-cost funds from Vanguard, Fidelity, and Dimensional Fund Advisors.

Keep Plan Providers Honest by Paying Plan Fees Directly to the Provider

Plan provider and fiduciary advisor fees that are paid directly by the employer (plan sponsor) are tax-deductible as an expense.

If plan provider and advisor fees are deducted directly from plan assets (e.g., participant accounts) they are not tax-deductible and can hide a myriad of fees and serve as a cloak for high cost mutual funds with hidden 12b-1 revenue sharing fees and expensive asset-based fees. We give plan sponsors the option to pay a portion or all of the plan's fees directly to us and their plan provider or bill the plan's assets. Another reason to consider flat-fee pricing combined with low-cost, no commission, no revenue-sharing mutual funds.

Questions to ask a potential Retirement Plan Advisor:

- Are you Certified Financial Planner (CFP) professionals? What type of retirement planning education will you provide to our employees?

- What are the total costs associated with the plan? Typical plan fees include, recordkeeping costs, third party administrator fees, custodian fees, plan (financial) advisor fees, mutual fund expense ratios and the weighted expense ratios of the model portfolios. Have the advisor list all of these fees in a simple, easy to understand format. If you are unsure how to calculate a basis point fee based on plan assets, ask the advisor to calculate the fee into dollars. This is important to have in writing!

- How are plan fees calculated? Are plan fees fixed and reviewed each year? Are you using expensive mutual funds with 12b-1 fees to offset (hide) plan expenses, when a lower cost share class for the same fund is available? If so, why?

- How are the plan provider and advisor paid? Is it based on a percentage of the assets in the plan or on a flat per participant basis? Do not pay a provider or an advisor based on a percentage of your plan's assets!