Have Value Stocks Begun a Long-Awaited Comeback?

As we noted in our Outlook for 2021 and Beyond, the Vanguard Capital Markets Model is forecasting a higher return for U.S. value stocks vs. growth stocks over the next decade. This would be a most welcome change, as the prior decade has seen massive outperformance of growth over value, especially for the final four years of it.

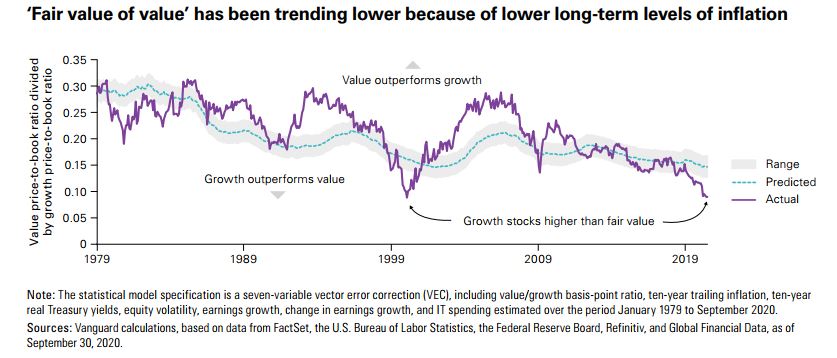

As Vanguard so bluntly put it, “The end of the ‘value coma’ is coming—we’re just not sure when.” Supporting evidence for this assertion is found in a time-series plot of price-to-book ratios of value stocks divided by the same ratio for growth stocks. This ratio of ratios shows that value stocks are at their lowest relative valuation since the beginning of 2000.

At this point, we could drag you through some numerical exercises showing that growth trounced value in the years leading up to 2000 followed by an epic reversal for the next decade. We could also show you that for the four years ending 12/31/2020, growth beat value by 18.7% per year (based on MSCI Prime Indices). Does this mean that value is poised to beat growth by a similar amount for the next few years? Certainly not! We would be surprised if it did. From the above-mentioned chart, we expect value stocks to have a higher-than-usual expected return compared to growth stocks but (and we can’t say this enough) having a higher expected return does not guarantee that realized returns will be higher.

Vanguard states point blank that their research indicates that the value premium (the tendency for value stocks to outperform growth stocks in the long run) does exist. In our opinion, the reason for the premium is the higher level of risk inherent in value companies that is reflected in their lower (i.e., more highly discounted) prices. Investors who accept higher risk rightfully expect to be rewarded with higher returns. To be clear, investors in value (and small cap) companies do not receive a free lunch. They earn their returns by sitting through long periods of underperformance like the one we just experienced.

For investors who are willing to endure these painful periods, we believe there are two sensible ways to access the value premium. The first way is to own a single broad market fund that is moderately tilted towards value stocks, and the second way is to have an allocation to a pure value fund in combination with a broad market fund. We would never endorse owning a pure value fund as one’s entire allocation to equities.

So how are value stocks faring in the first few weeks of 2021? As of the close on 1/21, the Vanguard Value Index Fund (VVIAX) was up 2.97% compared to 2.59% for the Vanguard Growth Index Fund (VIGAX). This 0.38% difference is a long way from Vanguard’s expected annual difference of 3.7% for the decade. Of course, quite a lot can happen in a year, as we saw in 2020.

If you would like to discuss your asset allocation in relation to exposure to value or other factors, please feel free to reach out to us.