There are three components of successful investing: Minimize costs, maximize diversification, and control behavior. Learn more about the poor behaviors that can

Read More

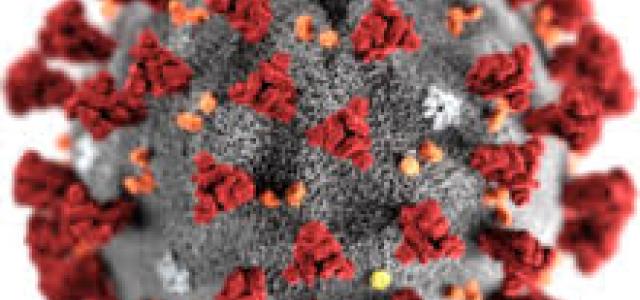

The Dow has dropped over 2,000 points for the three days ending 2/26/2020, what should investors do?

Read More

In Warren Buffett’s 2017 letter to shareholders of Berkshire Hathaway, he lays out the details of his overwhelming victory in his 10-year bet on a Vanguard

In response to Warren Buffett’s most recent Berkshire Hathaway shareholder letter which details an all-but-certain victory in his ten-year bet on the